As the number of online transactions increases, fraud prevention is becoming even more important for increasing sales and protecting your business. The digital world is expanding and this means that fraudsters are looking for different ways to take advantage of sensitive information that you store on your database.

This is why many companies worldwide are now looking for fraud management solutions. Protecting your users data is the key to increasing sales and making sure they are comfortable enough to come back and make another purchase in the future.

In this article, we’ll dive deeper into learning more about how you can maximize sales and minimize fraud.

Implement identity verification practices

Identifying the customer’s ID whenever they interact with your brand is highly important for preventing potential fraud. A few ways you can interact with and verify your customer’s ID include:

- Two-factor authentication: Requires users to submit tokens as a form of ID verification after they enter a password. The token is sent via text message on your mobile phone to confirm that you are the one logging in.

- Biometric verification: Includes facial recognition, voice recognition, fingerprints, and retina scanning.

- Knowledge-base authentication: Requires users to answer security questions whenever they log in, or fail to enter the right password. This makes it nearly impossible for a fraudster to get a hold of your information.

It’s highly difficult for a fraudster to get access to sensitive information when they need to go through ID verification protocols. This way, it makes it challenging for fraudsters to get a hold of sensitive information.

Get exclusive access to all things tech-savvy, and be the first to receive

the latest updates directly in your inbox.

Prevent and monitor transaction fraud

Transaction fraud is going up and it’s now becoming more important than ever to prevent them. There are three important steps to follow to prevent transaction fraud.

First, it’s important to Gather consumer insights. Don’t burden your customers with verifications, but find a balance between everything. Find a solution that doesn’t underestimate the customer experience and allows you to gather insights for making informed decisions.

A good way to begin is by analyzing email addresses and making sure that there’s no data breach history, and checking out when the email address was created. Then, we have phone numbers, which you need to make sure the number is valid and if any other social and digital profiles are connected to it.

IP addresses are also important to look at since they make sure customer IP is connected to your services and doesn’t redirect you to a proxy, or an emulator. If the IP differs from the address stated on the cardholder’s shipping address, there’s a problem here.

Secondly, it’s essential to leverage machine learning insights. Artificial Intelligence (AI) algorithms and Machine Learning (ML) are important for fraud prevention since they get more accurate as you give them more data. You can train these algorithms by flagging fraudulent transactions so they can automatically connect the dots and recurring patterns. This helps since the learning model system becomes better every time it stops fraud since it learns from past mistakes.

See SEON, for example, they have a whitebox and blackbox machine learning system. Both these machine learning systems will recommend new rules to help spot suspicious behaviors of users. After the system makes a decision, you can calculate the accuracy of the rules and make decisions automatically.

The whitebox rule will work much better after it has processed 1,000 transactions. After that, you have great suggestions to even prevent the toughest fraudsters out there. The blackbox ML, on the other hand, will take a close look at each user’s activity and inform you of any unusual behavior. The goal is the same for all fraud prevention tools that use AI technologies, to improve the accuracy of fraud detection.

Thirdly, you need to create custom rules. All extra information collected needs to be reviewed. Manually going through each user or transaction is time-consuming, so that’s why you need to use a fraud score. The higher the fraud score, the more a user will be flagged and automatically blocked from certain activities. Fraud scores rely on a customer’s history of fraud, the transaction type, amount, and location.

Use server-side tagging for tracking data

Server-side tagging is used as an approach for tracking data. As an alternative to depending on third-party services, you can take complete control. Server-side tagging makes sure that your customer’s data is hosted on a secure server, which gives you complete control and protection over the customer’s personal data, exactly what data privacy regulators are looking for.

Server-side tags act as a protective barrier between your customers and third-party vendors who are looking to get a hold of data they don’t have access to. This helps promote better security and control.

Additionally, server-side tagging is mostly well-known for preventing ad fraud and improving the accuracy of data by reducing the impact of ad blockers. Not only is the customer protected, your website and app performance increases. You can also modify and screen incoming requests to ensure data privacy.

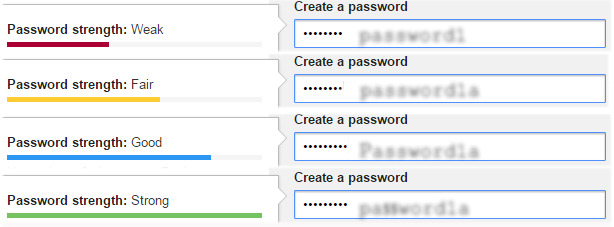

Implement strong password policies

Account takeovers can occur at any time. While many companies don’t have strong security policies, customers creating weak passwords is even more of an issue. The worst case scenario is when customers start to share their passwords with too many people; this is when passwords might fall into the wrong hands.

If too many people get a hold of a customer’s password, it might increase the chances of an ATO attack. However, you can save the day by encouraging your customers to create strong passwords that are from 8-14 characters, and include a combination of special characters, numbers, and letters.

Many websites will not allow you to create passwords before you follow the guidelines. For example, Google will show you a password meter, informing you how strong your password is against fraudsters.

Limit account-sharing capabilities

Allowing customers to share too many accounts may be beneficial for you, but at the same time, can make you lose revenue. Depending on the type of subscription you provide, it’s always a better idea to limit account sharing.

For instance, if you are offering streaming services in one household and want to allow account sharing, you can limit the amount of devices that can log in from the same IP address. This way, you are creating a balance that is both great for you and your customers.

Strictly preventing account sharing should only be done when you offer subscriptions that involve expensive items like online learning courses, or merchandise. If the policy isn’t respected, you can block out any login attempts that try account sharing.

This is even an effective method for preventing fraud from unauthorized access that can occur with account-sharing.

Analyze payment data

For many businesses, losing revenue happens since many fail to properly analyze the correct data and understand payment performance.

Payments offer a wealth of data for analyzing, from customers to fraud and financials, there’s plenty of information regarding your payments, processes, and products, which contributes to maximizing your revenue. Since 2011, payment frauds have tripled, and are expected to exceed $40 billion by 2027.

Revenue can be maximized by finding out which products are popular, which products need to be promoted, and understanding more about payments that get declined. Many modern-day fraud detection tools use ML algorithms to automatically analyze payment data and show you any suspicious activities.

Take advantage of network tokens

Network tokens are used as alphanumeric digits that replace a customer’s primary account number (PAN) on their credit or debit card in a transaction. In other words, these tokens act like references, which is great for protecting a customer’s sensitive information since they have no relevance outside the system. Even if an online attacker does get their hands on these tokens, they won’t be able to decode the data.

This is because tokenized transactions are non-reversible, making it impossible to steal sensitive information. After the payment is complete, sensitive consumer data is replaced by non-sensitive information. Using network tokens is great for boosting payment acceptance rates, getting rid of out-of-date credentials, and improving the customer-buyer journey.

Include local payment methods

Local payments are an excellent way to maximize revenues. 77% of online business purchases use local payment methods. The lack of local payment methods offered is due to growing international demands.

You’d be surprised that local payment methods like Stripe help in reducing chargebacks and let’s not forget, chargebacks are increasingly difficult to prevent entirely. Multiple localized payment methods decrease checkout abandonment, which initiates a chargeback in the first place. Additionally, they leverage advanced technology to enhance security and protection against potential fraud like chargebacks.

Fraud is what can ruin your business reputation

Your company’s reputation can easily be ruined if you aren’t taking the right measures to prevent fraud. Fraud can come in different forms, and the most important part is to make sure you are using the right tool to prevent it.

While there are different steps you need to take to prevent fraud, it’s important to take action immediately even if it does hit you. You have better things to do with your time, like finding new ways to attract customers and protect their information at all costs.