2026 is here, and cryptocurrency regulatory pressure is more real than ever. The DAC8 rules came into effect on 1 January 2026 to expand tax transparency to all crypto-asset transactions. The primary goal of this directive is to strengthen the overall legal framework for the automatic exchange of information to combat tax evasion and fraud within the EU. Whether you are operating from Stockholm, Singapore, Texas or Johannesburg, if your platform has any EU users, the new directive applies to you.

The transformation is not limited to Europe. Across the Atlantic, American taxpayers are currently opening their mailboxes to find the first-ever IRS Form 1099-DA that signifies the tax authority’s growing grip on digital-asset broker reporting.

This is bad news for investors because these new regulatory frameworks present a quite difficult choice: hand over all your historical financial data to a third-party SaaS platform or try to build a private, sovereign pipeline to help you manage your own compliance.

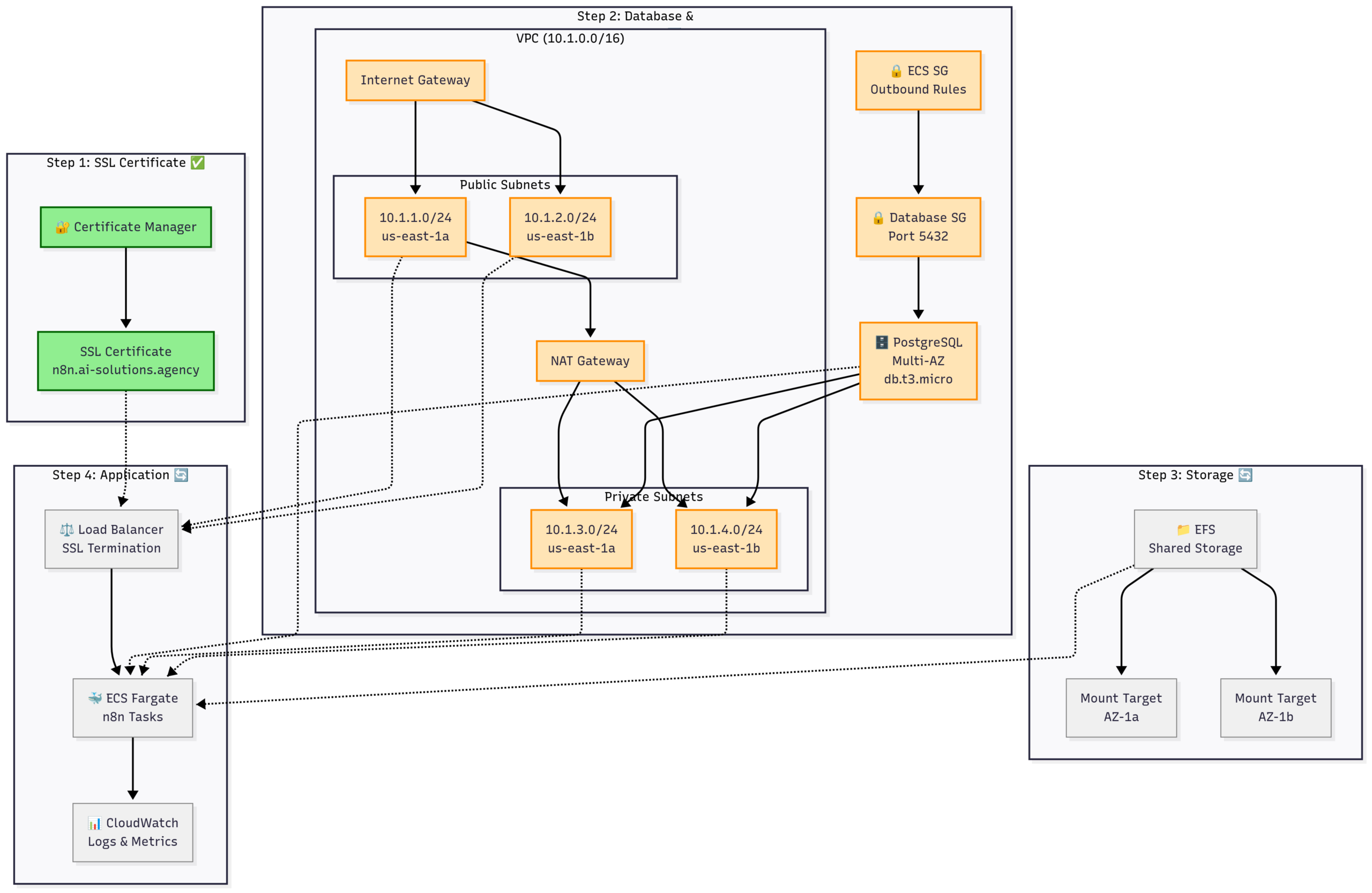

The most exciting solution for many has been n8n. However, the stakes for self-hosting have never been higher. Following a series of high-profile critical security vulnerabilities reported in 2025, the one-click deployment strategy poses a significant risk to sensitive financial data.

To navigate the tough days ahead securely, you need something more than a simple automation. You need a hardened infrastructure. In this guide, we evaluate why building a professional-grade, secure crypto tax pipeline using CyberPanel makes sense. Read on to learn more.

Why Crypto Data Collection Keeps Breaking

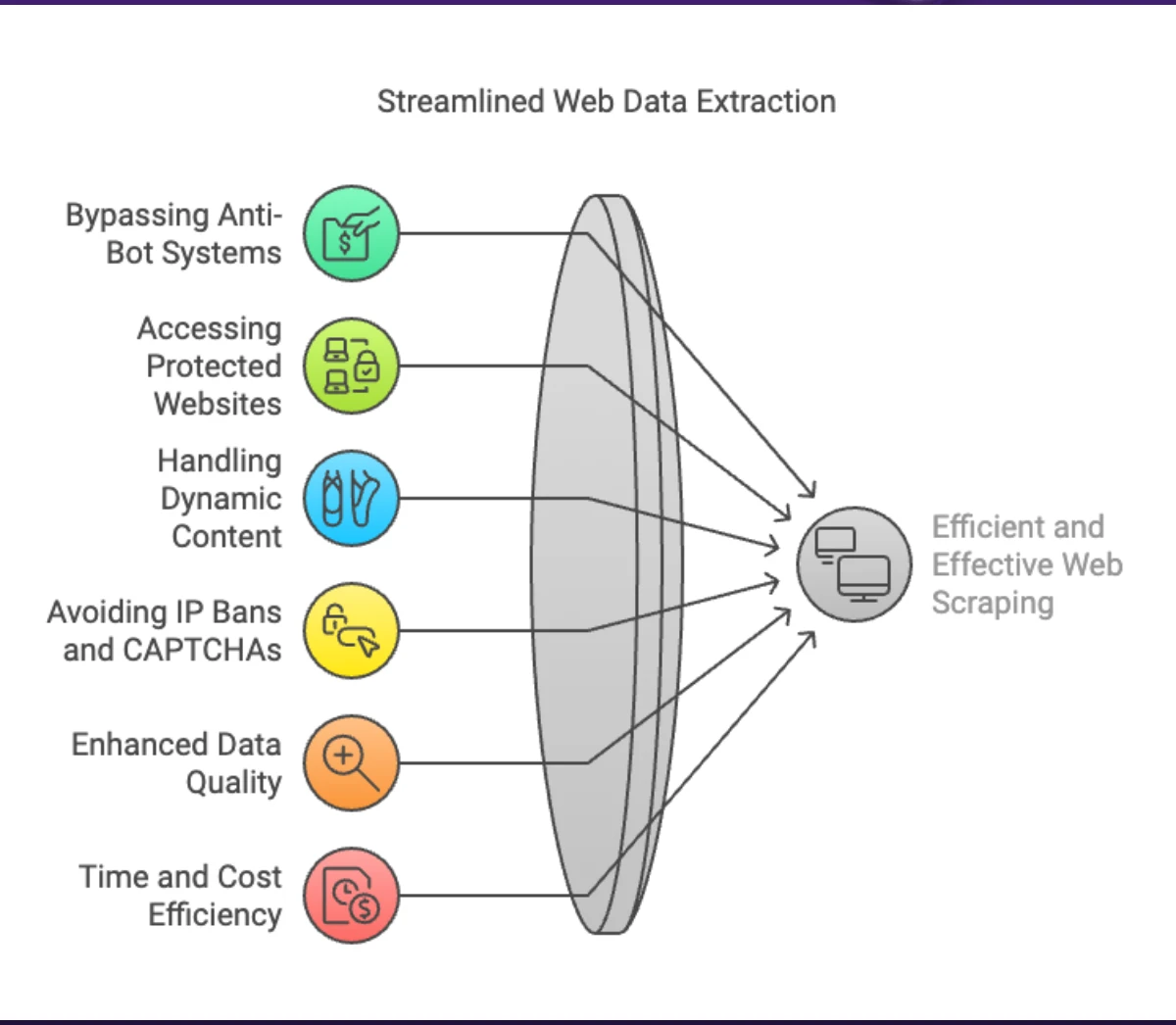

Since the start of last year, pulling data from crypto exchanges, help centers, and other public endpoints has become extremely fragile and complex because anti-bot defenses are no longer basic rate limiters.

Get exclusive access to all things tech-savvy, and be the first to receive

the latest updates directly in your inbox.

Roman Milyushkevich, CTO at HasData, says that many platforms now combine behavioral fingerprinting, rotating tokens, IP reputation scoring and JavaScript challenges to distinguish real human users from automated bot access. “Even endpoints that appear public often sit behind tight bot mitigation layers that change frequently. It means that scripts that worked perfectly fine last month can suddenly start returning partial data or blocked responses,” he adds.

In a standard crypto pipeline, this inconsistency creates a dangerous illusion of success: workflows continue running as expected but produce incomplete or inaccurate data records.

So, what does all this mean? To remain stable and secure, a crypto tax pipeline needs to behave more like a real human user than a conventional high-speed crawler. That means enforcing conservative rate limits, maintaining session continuity rather than firing stateless requests, and, most importantly, adding intelligent retries with backoff. JavaScript rendering is becoming a non-negotiable for all pages that hide data behind client-side logic. Proper header and cookie handling can also help prevent automated defenses from triggering.

What Does It Mean to Be Compliant-Ready?

Being compliant-ready in 2026 is no longer a vague term treated as an afterthought. It is now a rigorous data standard, enforced by the legal frameworks we mentioned above. For the first time in history, cryptocurrency platforms are legally required to report what you traded, including the specific Digital Token Identifier and the exact timestamp of the transaction.

Critically, though, they are required to report your gross profits adjusted for transaction fees. This means that the EU block and IRS will have a clear view of your crypto dealings and if your internal records don’t align with these consistent identifiers, your tax return will automatically trigger a red flag.

David Kemmerer, CEO of a crypto taxation software company CoinLedger, says that the most common failure for self-hosting investors is data drift caused by missing or inaccurate data and mismatched timestamps across crypto exchanges that often archive or prune historical records. “Relying on manual exports is a recipe for disaster in 2026 and beyond because these files often fail to capture the complex internal transfers required for accurate reporting,” he adds.

Building an n8n crypto tax pipeline for daily ingestion ensures that every transaction you are involved in is captured in real time, keeping your transactional records in a central place and ready for reconciliation when your DAC8 or 1099-DA statements arrive.

What Should a Crypto Tax Pipeline Handle?

Before you build any system or automation pipeline, you must outline the primary goals you want to achieve. Currently, many crypto investors have their data scattered across different crypto exchanges and non-custodial wallets. Each platform generates information in different formats with advanced structures incompatible with each other.

Therefore, a good crypto tax pipeline must be able to extract, transform and load data. Its primary purpose is to consolidate data from multiple, disparate sources and systems to address fragmented data across dozens of sources, ensuring compliance.

Once the data is collected and consolidated in a central place, all transactions must be normalized into a standard format, duplicates eliminated and transfers between owned wallets must be identified to eliminate the risk of false tax events.

The pipeline must also be able to calculate your cost basis using methods accepted in the EU or the United States, and then create simple-to-understand reports, clearly formatted to meet the minimum regulatory requirements. The pipeline must be designed to fit the compliance requirements of a specified jurisdiction. In other words, a pipeline built for the EU’s DAC8 rules will not be the same as one built to comply with IRS Form 1099-DA.

Self-Hosting on N8N: Why and Why Not

Self-hosting on n8n is not entirely a bad idea. The platform is attractive for some crypto tax workflows because it gives you full control over your financial data. You can easily lock in your transaction history and eliminate the need for third-party exposure. The goal is still to reduce compliance risk.

The platform also allows you to build custom logic for different regulatory regimes. For instance, you can create a single workflow that aligns the outputs with the EU’s DAC8 requirements while handling IRS 1099-DA reporting differently.

However, the control you enjoy from self-hosting n8n often comes with a risk. Recent critical vulnerabilities in self-hosted n8n deployments have exposed how dangerous insecure configurations can be. Typically, many one-click installation setups prioritize convenience over security.

These workflows ship with weak defaults, unauthenticated webhook endpoints and publicly accessible admin interfaces. These flaws carry a massive risk in the context of crypto tax. A single exposed workflow can expose your transaction data, calculated tax outputs and API credentials, landing you on the wrong side of the law.

Why CyberPanel?

If you are serious about navigating the high stakes of crypto tax compliance in 2026, you must think beyond the n8n self-hosting option. Your hosting control panel is both a security and performance decision. Having tried several platforms, CyberPanel stands out because it is built on the OpenLiteSpeed web server, which consistently outperforms Apache and NGINX in high-concurrency environments.

When your n8n crypto tax pipeline is engaged in high-frequency API rolling, OpenLiteSpeed can handle the simultaneous connections with a significantly lower CPU and memory footprint.

Its native LSCache engine also provides a critical buffer that allows your server to handle all incoming webhooks and relatively heavy data transformations without the latency spikes that often lead to failed executions in conventional setups.

Summary

As crypto tax reporting moves into a more regulated and closely monitored era, automation is no longer optional. However, insecure and unreliable automation is a massive liability you must avoid at all costs.

Self-hosting your n8n automation on CyberPanel offers the control, flexibility, and cost efficiency you need to build compliant crypto tax pipelines for DAC8 and 1099-DA regulations.

With advanced infrastructure and data handling mechanisms, you can be assured of defensible, auditable and stable pipelines that pass regulatory scrutiny.